2024-2025 overview of case law relating to shareholders’ agreements – trends and lessons learned

⊕ Shareholder agreements remain an essential contractual instrument for corporate governance, at the crossroads of contract law and company law.

⊕ Recent case law (2024-2025) has refined their scope in several key areas: transfer of securities, leaver clauses, governance, and related obligations.

⊕ We offer a detailed review of the decisions handed down by civil and commercial courts between October 2024 and October 2025 relating to shareholders’ agreements.

⊕ This overview covers the various aspects of this subject at the intersection of company law, contract law and labour law, highlighting the most significant trends in recent case law.

⊕ Only the most informative and instructive decisions have been selected, whether or not they have been published. The aim is not to be exhaustive, but to put into perspective the way in which judges, particularly the courts of appeal and the Court of Cassation, are gradually refining the legal regime governing shareholders’ agreements.

⊕ The past year has confirmed the trend towards rigorous judicial review of the wording of clauses, without calling into question the contractual freedom that underpins these instruments, through a twofold trend: tighter scrutiny of validity by the judge and application of the principles of contract interpretation set out in Articles 1188 et seq. of the Civil Code.

Summary:

I. LEGAL CLASSIFICATION OF PARTNERSHIP AGREEMENTS

1.1. Adherence to and enforceability of the agreement

1.2. Contract of adhesion or contract by mutual agreement?

II. TRANSFER OF SECURITIES: BETWEEN STRICT DRAFTING AND RECOGNITION OF CONTRACTUAL FREEDOM

2.1. Drag-along clause: precision as a condition of validity

2.2. Date of transfer of securities and mandate for forced execution of transfers: validation of the mechanism

2.3. Buy or sell clause: enshrined in case law

2.4. A fixed sale price takes precedence over an appraisal procedure

2.5. Fraudulent use of the approval clause

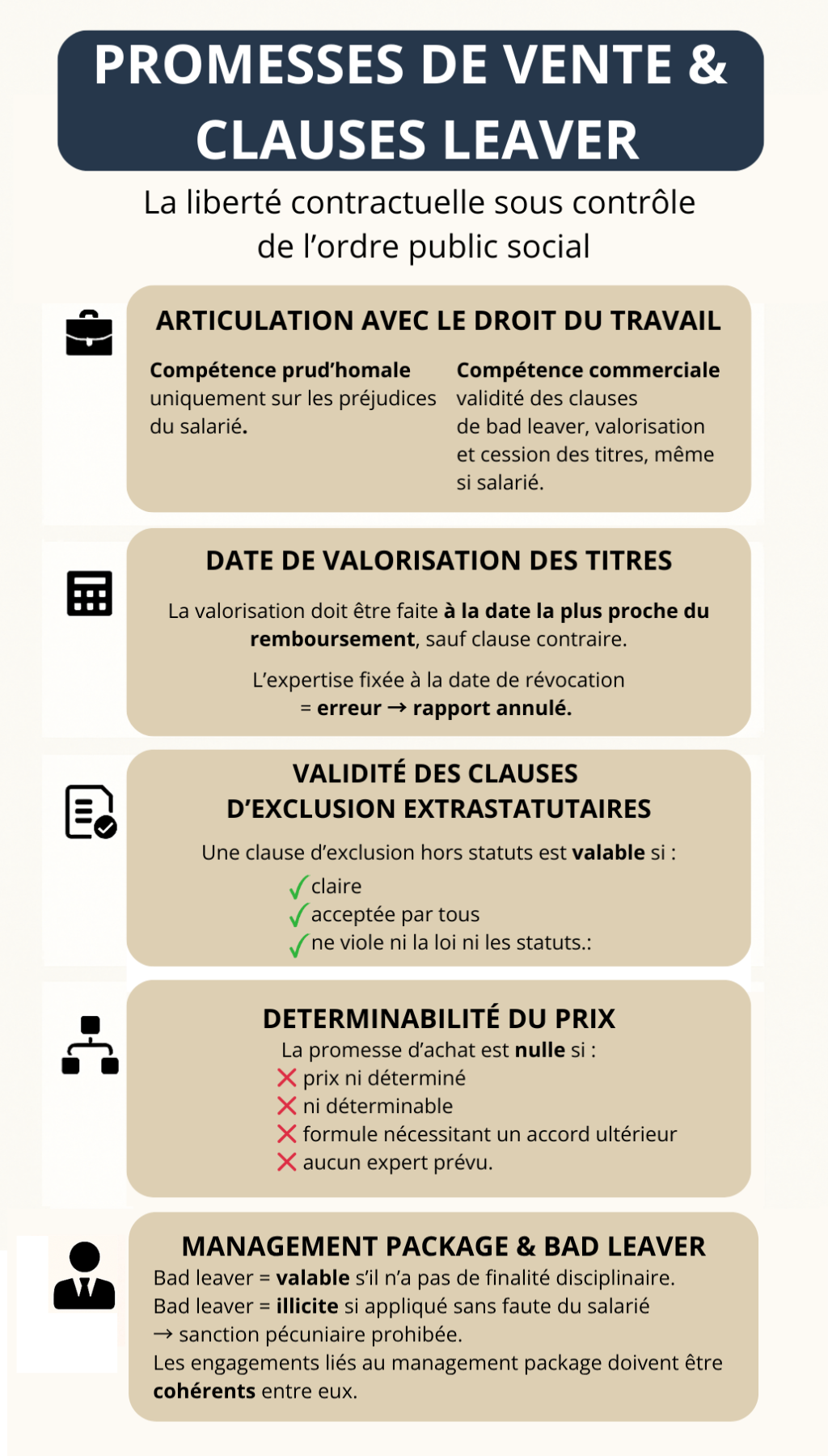

III. PROMISES TO SELL AND “LEAVER” CLAUSES: CONTRACTUAL FREEDOM SUBJECT TO SOCIAL PUBLIC POLICY

3.1. Relationship with labour law: limited jurisdiction of industrial tribunals

3.2. Date of valuation of securities

3.3. Validity of extra-statutory exclusion clauses

3.4. Determinability of price

3.5. Management package and bad leaver: consistency of commitments and case law

IV. GOVERNANCE AND MANAGEMENT OF CONFLICTS BETWEEN PARTNERS

4.1. Concrete assessment of facts constituting serious misconduct

4.2. Primacy of SAS articles of association over a unanimous decision by partners

4.3. Primacy of SAS articles of association without disregarding the scope of agreements between partners

V. NON-COMPETITION CLAUSES: JUDICIAL FIRMNESS AND PRAGMATISM

5.1. Exception of non-performance and reciprocity of obligations

5.2. Effectiveness without proof of damage

5.3. Absence of consideration: recourse to the collective agreement

5.4. Nullity of disproportionate clauses

5.5. Reference dates for a non-competition clause

VI. CONFIDENTIALITY AND PRODUCTION OF THE AGREEMENT TO A THIRD PARTY

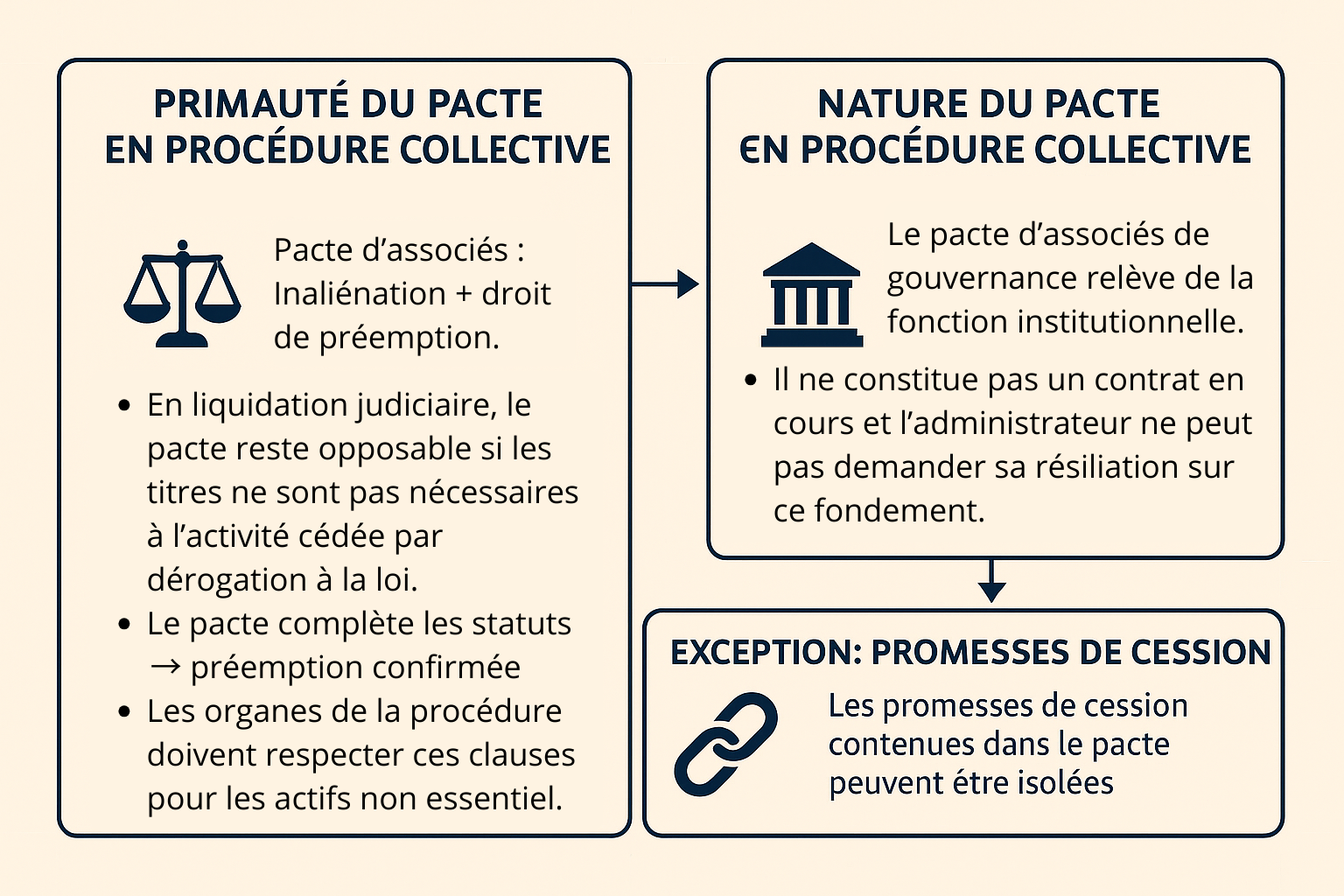

VII. COLLECTIVE PROCEDURES: PROTECTION OF CORPORATE STABILITY

7.1. Primacy of the agreement over the transfer plan

7.2. The agreement does not constitute a current contract within the meaning of Article L.622-13 IV of the Commercial Code

I. LEGAL CLASSIFICATION OF PARTNERSHIP AGREEMENTS

1.1. Adherence to and enforceability of the agreement

CA Douai, 16 January 2025, No. 21/06235

In this case, a shareholders’ agreement bound a majority shareholder and a minority shareholder, providing for a promise to purchase the minority shareholder’s shares in the event, in particular, of the latter’s retirement. As the minority shareholder had transferred his shares to a holding company without the latter formally adhering to the agreement, the majority shareholder argued that the holding company’s exercise of the purchase promise was ineffective.

The court and the court of appeal ruled that the holding company, as a non-signatory, could not invoke the agreement. Furthermore, the conditions triggering the promise — such as retirement — only apply to natural persons, making it impossible in any event for a legal entity to exercise the promise.

This decision reaffirms the need for strict formal adherence and notification to make an agreement enforceable, despite an attempt by the minority shareholder to demonstrate the execution of the shareholders’ agreement after the contribution of securities.

1.2. Membership agreement or private agreement?

CA Paris, 23 September 2025, No. 23/02868

In this case, the former minority shareholder of a company argued that the shareholders’ agreements to which he had been a party should be classified as adhesion contracts, as the clauses had not been individually negotiated by the minority shareholders. He therefore considered that the obligation to sell his shares in the event of dismissal created a significant imbalance between the parties and that this clause should therefore be deemed unwritten.

After analysing the circumstances in which the agreements were signed, the Court of Appeal found that the agreements originally concluded were the result of discussions and negotiations between the original signatories, some of whom had even refused to sign, which ruled out their classification as adhesion contracts at the time of their formation.

The court added that the subsequent accession of partners, which was mandatory in order to acquire a stake in the capital, did not alter the initial nature of the contract, which remained a private contract. The distinction between initial partners and new entrants could not lead to a dual classification, at the risk of creating legal uncertainty.

In order to demonstrate informed consent and prevent any risk of reclassification as a membership contract, it is advisable to document the initial negotiations of the agreement, clearly inform members of its content before they acquire a stake in the company, and require that they be accompanied by legal counsel.

II. TRANSFER OF SECURITIES: BETWEEN STRICT DRAFTING AND RECOGNITION OF CONTRACTUAL FREEDOM

2.1. Drag-along clause: precision as a condition of validity

Cass. com., 27 November 2024, No. 23-10.385

The Court of Cassation censured a drag-along clause which, unlike the Court of Appeal, it characterised as a unilateral promise to sell without a fixed or determinable price. While the mechanism of the forced exit right is not called into question in principle, the Court emphasises the importance of rigorous drafting distinguishing between an offer from a third party and one from a partner.

The disputed clause provided that: “in the event of a firm offer to acquire exclusively all of the company’s shares, representing 100% of the share capital and voting rights of the company, made by one or more third parties and/or one or more shareholders (…), all signatories to this agreement irrevocably undertake to jointly transfer all of their shares to the purchaser (…) Each of the partners acknowledges that the foregoing provisions constitute a promise to sell their shares.”

The solution adopted by the Court of Cassation seems to result from the parties’ characterisation of the clause (which they described as a “promise to sell”) and from the fact that the beneficiary of the clause may be not only a third party but also a partner.

Pending further case law on the matter, it is important to clearly distinguish between offers made by a third party and those made by a partner, providing for an objective method of price determination (formula, expert, reference to a third-party offer) for the latter.

2.2. Date of transfer of securities and mandate for forced execution of transfers: validation of the mechanism

CA Versailles, 4 February 2025, No. 23/07631

In this case, several partners in a company had entered into an agreement providing for a promise to purchase the shares in the event of departure. Several partners left the company and contested the date of transfer of ownership of the shares, arguing that the sale was complete as soon as the promise to purchase was lifted and that it was on that date that the securities should be valued.

The Court of Appeal rejected this analysis: in accordance with the case law of the Court of Cassation (Cass. com., 18 September 2024, No. 23-10.455), it pointed out that, for unlisted shares, the transfer of ownership is governed by Article L. 228-1 of the Commercial Code and, in this case, by the shareholders’ agreement, by way of derogation from Article 1583 of the Civil Code.

Thus, the transfer only took place on the date the securities were registered in the purchaser’s account, as expressly provided for in the shareholders’ agreement. Consequently, the sale was only complete on that date. The valuation therefore had to be carried out on the date the securities were registered in the purchaser’s account.

This solution adopted by the Versailles Court of Appeal is similar to that adopted by the Angers Court of Appeal (CA Angers, 29 April 2025, 24/00803), as set out below.

The court also formally confirmed the validity of the irrevocable mandate given to the chairman to carry out the sales, rendering its revocation by the outgoing shareholders ineffective. The sales carried out by the chairman were therefore deemed to be valid.

2.3. Buy or sell clause: recognition in case law

Cass. com., 12 February 2025, No. 23-16.290

The High Court expressly validated the so-called “buy or sell” (or “American”) clause for the first time, confirming its validity and effectiveness in resolving deadlock situations.

Two co-managing partners of a limited liability company, one with a majority stake (60%), the other a minority shareholder (40%), had agreed on a “buy or sell” clause providing that in the event of a serious and persistent disagreement paralysing the company, one could offer to buy the other’s shares at a specified price, with the other being able to choose either to sell or to buy the shares at the same price.

The minority shareholder triggered the clause by setting a price of €10 per share. The majority shareholder refused to implement it, leading the minority shareholder to take the matter to court to obtain the forced sale of the majority shareholder’s shares.

The Court of Cassation validated the mechanism and the implementation of the disputed clause based on a two-step reasoning process:

On the validity of the mechanism:

- The Court recognised the original nature of the clause, describing it as a sui generis synallagmatic commitment enabling the resolution of a deadlock between partners.

- It considers that the price can be determined on the basis of the initial proposal made by the initiating partner: the setting of the price does not depend on the will of one party alone, as the other has the symmetrical choice of buying or selling on the same terms.

- Thus, the clause complies with Article 1591 of the Civil Code on price determination, contrary to the majority shareholder’s argument.

On implementation:

- The Court approves the finding by the trial judges of objective circumstances of serious and persistent disagreement, justifying the triggering of the clause.

- It rejected the argument based on the minority shareholder’s bad faith: in the absence of a stipulation requiring the disclosure of accounting documents, the duty of good faith (Article 1104 of the Civil Code) cannot restrict freely agreed contractual rights.

Since this mechanism for the exit of a partner is compatible with the rules for determining the price, the conditions for triggering it (blockage, disagreement, harm to the company’s interests) must be objectified.

2.4. A fixed sale price takes precedence over an appraisal procedure

CA Aix-en-Provence, 21 May 2025, No. 24/09476

The Court of Appeal confirms that the cross-promises of purchase and sale contained in a shareholders’ agreement are binding and may be enforced in court when the conditions set out therein are met.

In this case, as the beneficiary had opted for the fixed price agreed in the agreement, the debtor under the clause could not demand the appointment of an expert, even though this was provided for elsewhere in the agreement. Furthermore, the claim of fraud, which was not supported by specific evidence, did not constitute a serious challenge.

The court therefore ordered the forced execution of the transfer, confirming that an expert clause is superfluous when a price is set at the time the agreement is concluded.

This decision illustrates the principle of contract interpretation (Art. 1188 et seq. of the Civil Code): clauses must be performed in accordance with the common intention of the parties, as expressed in the agreement.

2.5. Fraudulent use of the approval clause

CA Angers, 10 June 2025, 22/02047

A shareholders’ agreement provided for preference, joint transfer and non-competition clauses. A company indirectly transferred its entire stake in the capital of the company covered by the agreement by selling its own company (a direct partner and party to the agreement) to a competitor.

The partners of the company party to the agreement challenged this transfer, arguing that it circumvented the clauses of the agreement, in particular the approval clause and the non-competition undertaking.

The court found that, formally, the approval clause applied only to the shares of the main company and not to those of the subsidiary. However, it noted that the transfer had been organised to neutralise the effect of the approval clause and allow a competitor to enter the market: it was therefore a case of fraud. Consequently, the court annulled the transfer.

Thus, even when a consent clause does not directly bind a third party, any arrangement designed to circumvent it may be classified as fraud and result in the cancellation of the transaction.

III. PROMISES TO SELL AND “LEAVER” CLAUSES: CONTRACTUAL FREEDOM SUBJECT TO SOCIAL PUBLIC POLICY

3.1. Relationship with labour law: limited jurisdiction of industrial tribunals

CA Paris, 28 November 2024, No. 23/05673

CA Versailles, 20 March 2025, No. 23/01515

CA Bordeaux, 10 April 2025, No. 22/03589

Under the terms of these three decisions, which apply the principle established by the social chamber of the Court of Cassation (Cass. soc., 7 June 2023, no. 21-24.514), the judges refine the boundary between commercial and labour jurisdiction.

Bad leaver clauses fall within the jurisdiction of the commercial court with regard to their validity, but the labour court remains competent for damages suffered by the employee during their implementation.

It is in this sense that the rulings handed down by the Paris Court of Appeal and the Versailles Court of Appeal allow the labour court to rule on the execution of a promise within a partnership agreement when it is linked to the partner’s status as an employee.

With regard to the ruling handed down by the Bordeaux Court of Appeal, it logically confirmed that disputes relating to the valuation or transfer of shares, even if indirectly linked to the employment contract, fall within the jurisdiction of the commercial court and not the labour court, in accordance with the jurisdiction clause provided for in the shareholders’ agreement.

3.2. Date of valuation of securities

CA Angers, 29 April 2025, 24/00803

A shareholders’ agreement provided for a synallagmatic promise to sell shares in the event of the dismissal of a corporate officer who was also a shareholder. After the promise to buy back the shares had been implemented and an expert had carried out a valuation, the parties disagreed in particular on the date of valuation of the shares (date of dismissal or date of repayment) and on the value determined by the expert.

In this decision, handed down on referral from the Court of Cassation, the Court of Appeal ruled that the expert had erred in valuing the shares on the date of dismissal. It pointed out that, unless otherwise specified, the valuation of the securities should be made on the date closest to the actual reimbursement of the corporate rights, and not on the date of dismissal.

The date of revocation could only have been used if it had been expressly stipulated in the terms of the shareholders’ agreement, which was not the case in this instance, and therefore logically led to the invalidity of the expert report.

3.3. Validity of extra-statutory exclusion clauses

CA Montpellier, 17 June 2025, No. 24/0518

In this case, an excluded partner contested the validity of his exclusion on the basis of the company’s shareholders’ agreement, arguing that the exclusion clause was unlawful because it was not included in the articles of association.

The judges considered that the exclusion clause, although extra-statutory, was valid since it did not contravene any public policy rules or the company’s articles of association.

The Court of Appeal thus reiterated that there is no general principle or legislative text prohibiting the validity of an exclusion clause by extra-statutory agreement, even for public limited companies, provided that this clause is clear, accepted by all signatories and does not derogate from the law or the articles of association.

3.4. Determinability of the price

CA Lyon, 24 July 2025, 21/07567

An agreement included a liquidity clause containing a promise to purchase that could be exercised at any time. The formula for calculating the price was detailed but was subsequently challenged on the grounds that it was indeterminate or indeterminable.

The Lyon Court of Appeal ruled that the purchase promise clause contained in the shareholders’ agreement was null and void, as the price was neither determined nor determinable: the valuation date of the net debt, which was essential for the calculation, was not specified, and the formula required subsequent agreement between the parties.

Furthermore, no mechanism for determining the price in the event of disagreement was provided for.

Consequently, the court annulled the promise to purchase provided for in the shareholders’ agreement.

3.5. Management package and bad leaver: consistency of commitments and case law

CA Paris, 18 October 2024, No. 22/09370

In a dispute between a former employee of a company holding BSPCE (stock options) and the company, the court considered that a bad leaver clause requiring the sale of shares at their purchase price in the event of a bad leaver was neither without consideration nor constituting a derisory price. In this case, the employee’s departure occurred 16 months after the date of allocation of the BSPCEs.

Furthermore, the court considered that the promise of sale resulting from the exercise of the BSPCEs was part of a set of contractual obligations that were compensated by the overall economic interest represented by access to the company’s capital.

CA Paris, 28 November 2024, No. 23/05673 (cited above)

An employee, holder of BSA warrants and signatory to a shareholders’ agreement containing a bad leaver clause, took note of the termination of her employment contract — subsequently analysed as a resignation.

The employer then implemented the forced sale clause provided for in cases of bad leavers, requiring the repurchase of her shares at £0.56, whereas a repurchase offer from the group a few days later set a valuation of close to £3.90 per share.

Contesting this implementation, the former employee argued that the clause was unlawful, as it was equivalent to a prohibited financial penalty, and that the transfer was abusive as it was carried out without her consent and in violation of the information obligations attached to the drag-along clause in the agreement.

The employer argued that the bad leaver mechanism was valid, justified by the employee’s voluntary resignation.

The Court of Appeal affirmed that even if the acknowledgement has the effect of a resignation, it does not necessarily imply fault on the part of the employee. However, the clause in the agreement relating to leavers provides for different transfer prices depending on whether the departure of the outgoing manager is involuntary and without fault (good leaver) or culpable (bad leaver). As no fault had been established by the employer, the application of the bad leaver clause constituted a financial penalty prohibited by the Labour Code.

Finally, noting that the employee had not been informed of the group’s takeover bid before the transfer mechanism was implemented and that her refusal to sign did not constitute any failure on her part, the court ruled that the transfer and the signing of the transfer documents by the company’s chairman were unfair and awarded compensation for the loss suffered, corresponding to the difference between the market price and the price received.

CA Versailles, 20 March 2025, No. 23/01515 (cited above)

In this case, the Versailles Court of Appeal had to examine a bad leaver clause in a promise of sale in the context of a dispute between an employee and his employer. The employee, who was also a partner in the company, argued that the bad leaver clause included in the promise of sale, which provided for the repurchase of his shares at a 50% discount, constituted a prohibited financial penalty.

The court ruled that the bad leaver clause did not have a disciplinary purpose since it also applied in the event of resignation or termination of a service contract (when the partner was not an employee): it could not therefore be considered a financial penalty, which is prohibited under the Labour Code.

CA Paris, 17 October 2024, No. 22/09530

A dispute arose between a minority holding company, which subsequently became the chair of an operating company, and a majority company that acquired a stake in the company following a transfer of control.

The two partners had entered into a memorandum of understanding providing for a capital gains transfer clause — referred to as a management package — in favour of the minority holding company, applicable in the event of a subsequent sale of the shares if the capital gains exceeded certain thresholds.

A subsequent letter of commitment specified the terms and conditions, while a shareholders’ agreement established a leaver mechanism in the event of the departure of a director.

Following the dismissal of the chairwoman, the majority company implemented the bad leaver sale promise provided for in the agreement, while refusing to execute the letter of commitment, arguing that the benefit of the management package was reserved for the incumbent executive.

The minority holding company sued the majority company for specific performance of the commitment, but the Paris Commercial Court dismissed the claim, considering the clause to be reserved for the incumbent executive.

When the case was brought before it, the Court of Appeal noted that the retrocession clause did not expressly or implicitly make its benefit conditional on the exercise of corporate office and ruled that the loss of the chairmanship did not exclude the right to retrocession since the holding company remained a shareholder at the time of the transfer triggering the clause.

While this solution is justified in light of the letter of the contract, it is nevertheless open to debate: the dismissal of the chairperson triggered the application of the bad leaver clause, and, unless there were factors not mentioned in the judgment, no actual transfer to a third party seemed to justify the implementation of the capital gains transfer.

Case law maintains a pragmatic approach here, focusing on the letter of the contract, even if this means departing from a purely functional logic.

IV. GOVERNANCE AND MANAGEMENT OF CONFLICTS BETWEEN PARTNERS

4.1. Concrete assessment of the qualitative facts of serious misconduct

CA Paris, 19 December 2024, No. 22/01737

A managing partner of an SAS (simplified joint stock company) had entered into a partnership agreement with another partner, which included the possibility of dismissing the chairman for just cause with the right to compensation, except in cases of serious or gross misconduct, by way of derogation from the articles of association, as well as a unilateral promise to purchase his shares for the benefit of the other party in the event of his departure.

Following a dispute between the partners, the chairman was dismissed for serious misconduct, whereupon he sought to (i) contest the serious misconduct that led to his dismissal, (ii) seek damages corresponding to the compensation that should have been paid to him following his dismissal, and (iii) depending on the judge’s decision (dismissal for serious misconduct or not), reserve the right to exercise the put option or not.

The Court of Appeal, after pointing out that the agreement validly derogated from the articles of association since the articles provided for dismissal ad nutum, subject to extra-statutory provisions, carried out an in concreto examination of all the grounds invoked by the company to characterise the serious misconduct (defined in the agreement as “extremely serious negligence or seriously deficient behaviour in the exercise of management functions”) and concluded that the dismissed Chairman had not committed serious misconduct, so that damages should be paid to him.

It should be noted that the court refused to allow the former Chairman, who was still a partner, to exercise the purchase option after the period contractually provided for the exercise of the option, even though the sale price would depend on the solution chosen by the judge (gross misconduct or absence of gross misconduct). It considered that the beneficiary of the promise should have exercised the option within the specified time limit and then challenged the purchase price.

4.2. Primacy of the SAS articles of association over a unanimous decision by the shareholders

Cass. com., 9 July 2025, No. 24-10.428

The articles of association of an SAS determine the conditions for the management of the company, in particular the procedures for dismissing its directors (Articles L. 227-1 and L. 227-5 of the Commercial Code). Although they may be supplemented by a decision of the shareholders, even if adopted unanimously, such a decision cannot derogate from the provisions of the articles of association.

This much-discussed decision illustrates the caution required of shareholders when drawing up an extra-statutory document, in particular internal regulations or a shareholders’ agreement. It serves as a reminder that such an instrument must not directly contradict the articles of association, even if all the shareholders agree to it.

In view of the reference and the terms used by the Court, this solution seems to be limited to situations where a legal provision explicitly entrusts the articles of association with the task of organising or providing for the existence of a mechanism.

4.3. Primacy of SAS articles of association without disregarding the scope of agreements between shareholders

Cass. com., 9 July 2025, No. 23-21.160

Under the terms of this decision, handed down on the same day as the one mentioned above, it was accepted that an investment protocol which personally committed its signatories to provide, upon the appointment of an SAS director, for the payment of compensation in the event of dismissal or reduction of powers before two years, was not contrary to the articles of association providing for dismissal without compensation.

Without contradicting decision no. 24-10.428, the ruling emphasises that, while the articles of association take precedence over any extra-statutory act seeking to derogate from them, their authority does not prohibit the partners (indirect in this case) from entering into contractual commitments favourable to the director. Thus, the primacy of the articles of association over the management of the SAS is maintained, but it allows for personal extra-statutory commitments that may grant additional benefits to the manager.

V. NON-COMPETITION CLAUSES: JUDICIAL FIRMNESS AND PRAGMATISM

5.1. Exception of non-performance and reciprocity of obligations

CA Bordeaux, 18 November 2024, No. 22/05577

When a partner breaches a non-competition obligation contained in a partnership agreement, the other partner may invoke the exception of non-performance (Article 1219 of the Civil Code) to breach their own non-competition obligation.

The court considers that a partner cannot claim the enforcement of a non-competition clause that they themselves have breached.

This ruling reminds us that a partnership agreement is first and foremost a contract, and is therefore subject to the general rules of contract law.

5.2. Effectiveness without proof of damage

CA Rouen, 30 January 2025, No. 23/02657

In this case, the court points out that the breach of a non-competition clause gives rise in any event to an obligation to pay compensation solely on the basis of the breach, even without proof of damage, in accordance with established case law (Cass. civ. 1re, 10 May 2005, no. 02-15.910).

The question remains as to how the amount of compensation is calculated, given that the non-competition clause did not appear to include a penalty clause and that the amount cannot be calculated on the basis of any damage (which has not been proven). This is undoubtedly why the amount of the award appears low – the court set it at €5,000.

5.3. Absence of consideration: recourse to the collective agreement

CA Lyon, 19 March 2025, No. 21/08314

This ruling by the Lyon Court of Appeal takes an original position: in a dispute between a former employee, who was also a partner, and the company concerning the application of a non-competition clause stipulated in a partnership agreement, the court ruled that, in the absence of financial compensation expressly provided for in the agreement, reference should be made to the collective agreement mentioned in the employment contract to determine the amount.

5.4. Nullity of disproportionate clauses

CA Nîmes, 13 June 2025, No. 23/01274

A clause prohibiting any competing activity for thirty years throughout the European Union was annulled. The judge considered that it disproportionately infringed on freedom of trade and industry.

The facts in question were extreme, but they serve as a reminder that the duration, geographical scope and purpose of a non-competition clause must be strictly proportionate to the legitimate social interest and that, in any event, the clause must not unduly restrict freedom of work and enterprise.

5.5. Reference dates for a non-competition clause

CA Paris, 1 October 2025, No. 23/19472

The non-competition clause in a shareholders’ agreement provided for a non-competition clause until the expiry of a period of 18 months from the later of the following dates: the date on which the shareholder concerned ceases to hold shares or the date on which he or she ceases to perform duties within the company.

After a detailed analysis of the non-competition clause and contrary to the arguments put forward by a former corporate officer who had been dismissed, the Paris Court of Appeal ruled that the non-competition undertaking was indeed applicable to her but that the 18-month period had not begun to run because the dismissed partner still held shares.

The Court also confirmed the right to non-competition compensation, but adjusted the amount to 30% of the last remuneration actually received and not to the remuneration that would have been voted on at the general meeting, since the minutes had not been signed.

VI. CONFIDENTIALITY AND DISCLOSURE OF THE AGREEMENT TO A THIRD PARTY

Cass. com., 12 March 2025, No. 23-21.845

In 2016, two companies entered into a partnership agreement providing for several reciprocal commitments, including transfers of shareholdings and a promise to sell applicable in the event of a change of control of one of the partners.

In 2019, investment funds acquired 56% of the capital of a company belonging to the group of one of the partners, which led the latter to exercise the promise to sell the securities of its co-contractor.

The latter contested the exercise of the promise, arguing that no real change of control had taken place.

The dispute focused on the request for the disclosure of the shareholders’ agreement entered into between the new investors, a document that the disputing partner considered necessary to establish the absence of a change of control.

The Court of Cassation confirmed that the Court of Appeal could refuse this disclosure without violating the right to a fair trial.

The ruling reaffirms that the judge has sovereign power to assess the usefulness and necessity of producing a shareholders’ agreement to a third party, and that refusal to disclose is not contrary to the right to a fair trial as long as it is justified by considerations of confidentiality and the absence of obvious evidentiary necessity.

VII. COLLECTIVE PROCEEDINGS: PROTECTION OF CORPORATE STABILITY

7.1. Primacy of the agreement over the transfer plan

CA Paris, 14 November 2024, No. 22/07272

Following the entry of investors, a company adopted new articles of association and signed a shareholders’ agreement providing, in particular, for a clause of inalienability and a reciprocal right of pre-emption on the shares.

During the judicial liquidation of a corporate partner, the securities it held were sold to a buyer as part of a partial asset disposal plan approved by the commercial court for a symbolic euro.

Considering that this sale violated the shareholders’ agreement, the minority shareholders claimed their right of pre-emption, arguing that the agreement, which supplemented the articles of association, remained applicable even in collective proceedings since the shares sold were not necessary for the transferred activity.

The transferees contested this enforceability, invoking the primacy of the articles of association, which they claimed were subsequent and liberalised transfers, as well as the authority of the judicial transfer plan, which they believed excluded any right of pre-emption.

The Court of Appeal rejected these arguments: the articles of association specify that the agreement supplements the rules on the transfer of securities and the exemption from the unenforceability of contractual clauses in the context of a transfer plan applies only to assets that are essential to the continuation of the business.

Noting that the transferees were fully aware of the agreement and of the partners’ intention to exercise their right of pre-emption, the court applied Article 1123 of the Civil Code and confirmed their substitution for the transferee.

It thus reaffirmed the principle established in case law (Com., 23 January 1996, No. 92-18.874): the bodies involved in collective proceedings remain bound to comply with pre-emption clauses when they relate to assets that are not essential to the business of the company in liquidation.

7.2. The agreement does not constitute a current contract within the meaning of Article L.622-13 IV of the Commercial Code

CA Saint-Denis de la Réunion, 2 July 2025, No. 25/00289

CA Saint-Denis de la Réunion, 2 July 2025, No. 25/00290

The Court of Appeal of Saint-Denis de la Réunion ruled that a shareholders’ agreement with an institutional purpose, organising the governance of a company, does not constitute a current contract within the meaning of Article L.622-13 IV of the Commercial Code. The official receiver cannot therefore request its termination on this basis, even if he considers that its execution is detrimental to the safeguard.

Indeed, because the agreement is part of the institutional function of the group, it is linked to the articles of association and is not subject to the rules governing successive performance contracts. In a second decision handed down on the same day, the court specified, however, that the transfer commitments contained in the agreement may, in exceptional circumstances, be examined in isolation, with termination only possible if strictly necessary for the protection of the debtor.

VIII. JURISDICTION AND CAPACITY TO ACT

CA Paris, 1 April 2025, 24/10851

The Court confirmed that the clause attributing jurisdiction to the commercial court in a shareholders’ agreement signed by a natural person is valid and enforceable provided that the signatory habitually carries out commercial activities.

In this case, one party to the agreement was recognised as a trader in view of its commercial activities (such as the management of tourist rentals) and independently of its status as a corporate officer, which rendered the deemed non-written clause provided for in Article 48 of the Code of Civil Procedure inapplicable.

The judge assesses the status of trader in concreto on the basis of the signatory’s economic behaviour.

CA Bordeaux, 10 April 2025, 22/03589

In this decision, the Court confirmed that disputes relating to the sale at a loss of shares by an employee who had become a shareholder do not fall within the jurisdiction of the labour court, but rather that of the commercial court, since they concern the performance of the shareholders’ agreement and not the employment contract.

In confirming the first judgment, which had declared the labour court incompetent, the Court found (i) that the agreement was not ancillary to the employment contract, (ii) that the dispute relating to the price and conditions of sale of the shares was unrelated to the employee/employer relationship, and (iii) that, in any event, the shareholders’ agreement contained a clause conferring exclusive jurisdiction on the Paris Commercial Court.

Consequently, the dispute, which was unrelated to the relationship of subordination, fell within the scope of the company’s corporate life, and the clause conferring jurisdiction on the Paris Commercial Court provided for in the agreement had to apply.

CA Paris, 3 September 2025, 23/08520

In this case, a former shareholder accused other shareholders of violating a pre-emption clause in the shareholders’ agreement, to which he had been a party, when shares were sold.

In their analysis, the judges found that the former shareholder had, in the context of a transfer agreement, expressly acknowledged that he had fulfilled all his rights under the shareholders’ agreement and waived any claim or action on that basis.

The court ruled that he had therefore lost all standing to act under the shareholders’ agreement and upheld the first instance judgment declaring his claims inadmissible.

This decision serves as a reminder that a waiver of the right to act under a shareholders’ agreement is valid and enforceable if it is clear, unequivocal and brought to the attention of an informed and advised party at the time of signing.

Case law in 2024-2025 thus confirms a trend towards contractual maturation of shareholders’ agreements:

- The judges confirm the validity of drag-along, buy-or-sell and bad leaver mechanisms, but require greater rigour in their drafting;

- They preserve the autonomy of company law while cautiously incorporating the requirements of labour law and common contract law;

- They reiterate the primacy of the articles of association over extra-statutory commitments.

- Finally, they reaffirm the operational scope of the agreement as an instrument of stability and governance.

Our team assists you in structuring and securing your shareholder agreements in order to anticipate litigation risks and preserve the stability of your governance and shareholding structure in a constantly evolving legal environment.